Phishers eyeing Australian Tax Payers

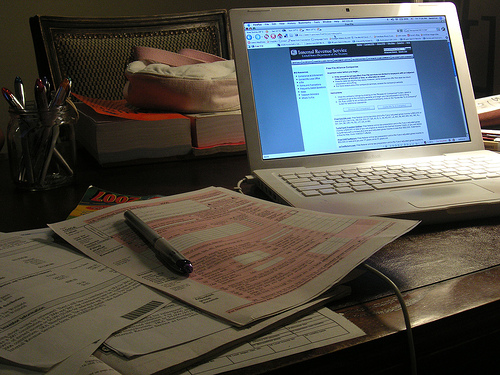

Photo by: Blmurch

Internet security solutions provider F-Secure Corporation is warning Australian taxpayers to be wary of phishing scams while filing their tax returns online this year. Taking a cue from what happened in America earlier this year, the agency thinks phishing fraudsters maybe looking at replicating the success they enjoyed in the US, here.

Typically, such scams use malevolent emails as their weapon. They send these emails to as many people as they can, hoping to snare a few victims here and there. Pretending to come from the Government, the emails lure their victims into giving away their confidential information like tax file number, postal address, date of birth, bank account details and salary information by promising certain incentives.

The fraudsters, posing as government officials, sometimes dangle the incentive of an early tax refund to their victims. Sometimes, they offer a reward of $80 for participating in an online customer satisfaction survey. At other times, the scam promises them an easier way to receive their tax refunds by offering to send refunds directly into their bank accounts.

The fraudsters have also found out a way of using new sophisticated security measures, like the practice of issuing a security certificate when returns are filed, to their ends. In this case, the email asks recipients for their confidential data on the pretext of updating their security certificate.

The fraudsters can also stuff their emails with links that cause a download of malicious programs inside the user’s computer, when they are clicked.

In a media release, F-Secure gives away some useful tips that taxpayers can use to stay from the scam:

- Be vigilant when receiving emails or phone calls from the Australian Taxation Office (ATO) – genuine representatives won’t ask you for your credit card details.

- Lodge your tax refund claim on the genuine website (www.ato.gov.au) and don’t follow any links in emails. Phishing websites normally have a numerical code or a different country domain in their URL although the click-through link looks genuine.

- Keep your security software up to date, and install firewall and anti-spyware software to protect your computer from Trojans.

- Report suspicious emails and phone calls to Scam Watch, an organisation by the Australian Competition and Consumer Commission (www.scamwatch.gov.au)

- Check your bank account and credit card statements when you get them. If you see a transaction you cannot explain, report it immediately to your credit union or bank.

The warning issued by F-Secure is timely as the ATO is expecting 1.9 million taxpayers to use its online service to file their returns this year.

Related posts:

- IRS 2010 List of Dirty Dozen Tax Scams - Ringing Bells for Tax Payers

- New IRS Tax Refund Scam, warns FBI

- Spear Phishing Scams-Netting your personal information.

- IRS ‘tax refund’ phishing e-mails- Adding to tax season blues.

- Avoiding Tax Scam in Tax Season